Gold Price Forecast: XAUUSD bears eye $1,820 and $1,816 as next targets – Confluence Detector

- Gold Price rebound lacks follow-through bias, as Treasury yields firm up.

- USD stays sluggish amid a better mood, ahead of NATO, ECB Forum.

- Oil price surge keeps the demand for XAUUSD underpinned.

Optimism prevails, pointing to a turnaround Tuesday for the financial markets, as the previous week’s upbeat global momentum returns and caps the broad US dollar recovery. Investors, however, remain wary ahead of the key NATO Summit and a policy panel of the heads of the Fed, BOE and ECB due later this week. The sluggish price action in the dollar is helping Gold Price recoup a part of Monday’s sharp decline. The upside in the yellow metal lacks traction, as the US Treasury yields resume their gradual recovery mode amid lingering recession fears and an aggressive Fed rate-hike track. Buyers also remain cautious, as a slew of key US economic data are due for release later this week, which may prompt markets to re-price the hawkish Fed expectations, in turn impacting gold valuations.

Also read: Gold Price Forecast: Can XAUUSD bulls defend the critical $1,820 support?

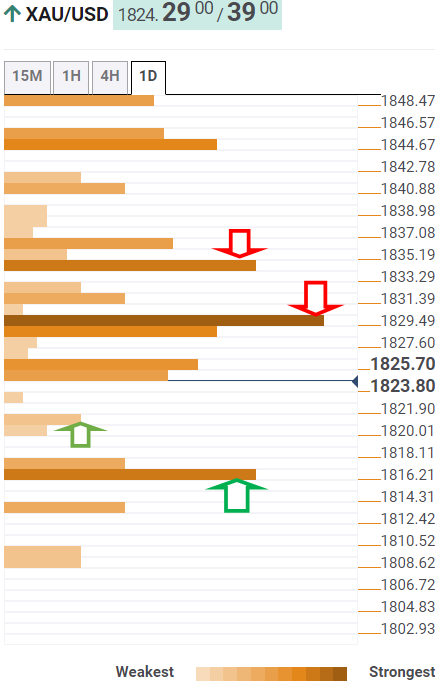

Gold Price: Key levels to watch

The Technical Confluence Detector shows that Gold Price is approaching the strong support around $1,820, where the previous day’s low and the Bollinger Band four-hour Lower merge.

Selling interest may pick up steam below the latter, exposing the convergence of the previous week’s low, Fibonacci 23.6% one-month and pivot point one-day S1 at $1,816.

The line in the sand for gold optimists is seen at the pivot point one-week S1 at $1,813.

On the flip side, bulls need to find a strong foothold above the $1,829 barrier, which is the confluence of the SMA5 one-day, Fibonacci 38.2% one-day and one-week.

The next stop for bulls is aligned at the SMA10 one-day at $1,832, above which the Fibonacci 61.8% one-day at $1,835 will come to sellers’ rescue.

Further up, the intersection of the Fibonacci 61.8% one-week and pivot point one-day R1 at $1,837 will offer stiff resistance.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.