Back

22 Jun 2020

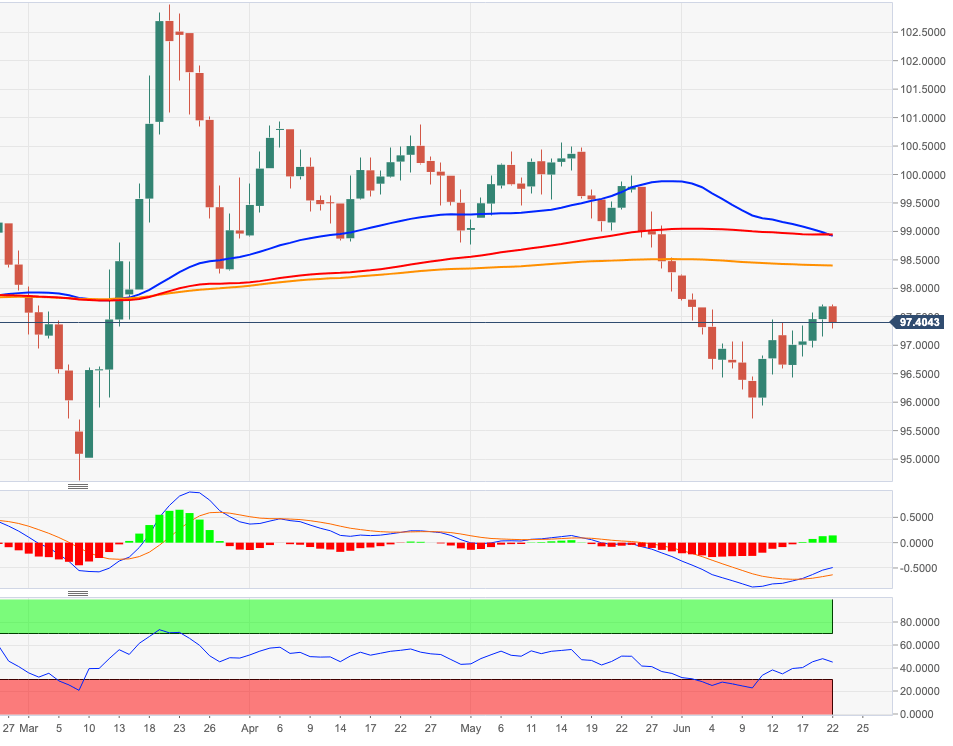

US Dollar Index Price Analysis: A breakout of 97.87 should expose the 200-day SMA

- DXY struggles for direction ahead of key Fibo level at 97.87.

- Further north emerges the 200-day SMA near 98.40.

The rebound in DXY from recent 3-month lows in the 95.70 region (June 10) appears to have met quite tough a barrier ahead of the 97.90 region, where sits a key Fibo retracement of the 2017-2018 drop.

If the recovery picks up a more serious tone, then there is room for a re-visit to the critical 200-day SMA, today at 98.39.

Above the 200-day SMA, the dollar’s outlook is expected to shift to positive.

DXY daily chart