Back

22 Jun 2020

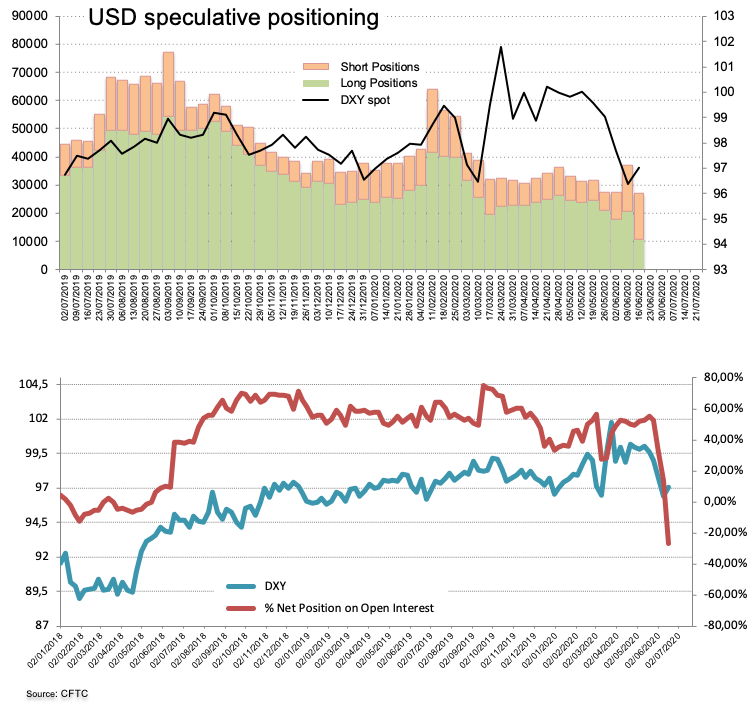

CFTC Positioning Report: Investors are now net shorts USD

These are the main highlights of the latest CFTC Positioning Report for the week ended on June 16th:

- The speculative community is net short the USD for the first time since early May 2018. In fact, the re-opening of economies around the world in combination with the firm commitment of the Federal Reserve to keep the loose monetary stance for the foreseeable future have undermined further the sentiment around the buck.

- By the same token, EUR net longs climbed to levels last seen in May 8th 2018. The constructive mood around the shared currency has been supported further by positive data results, hinting at the idea that the worst of the coronavirus impact on the economy could be behind.

- Net shorts in the British pound receded to multi-week lows on the back of the preference for riskier assets as well as some encouraging headlines regarding the UK-EU negotiation on trade in the post-Brexit era.